According to new data from Carta, time between primary US venture rounds is getting longer. Key takeaways include:

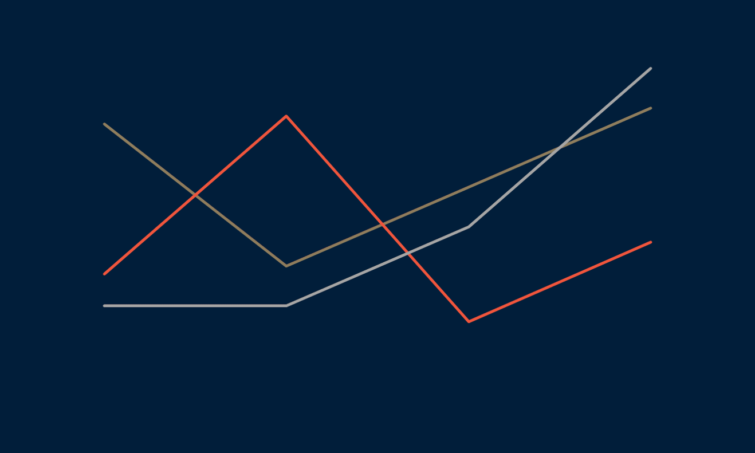

- The time between primary rounds of venture capital has significantly increased at every stage of the startup lifecycle:

- Startups now take over 2 years to raise a Series A after their priced Seed round.

- 844 days between Series A and Series B rounds.

- 1,090 days between Series B and Series C rounds.

- The gap between primary rounds has lengthened by approximately 20%-30% over the past year, indicating a trend towards extended fundraising timelines.

- Startups facing challenges in raising the next primary round can consider the following strategies:

- Raise a bridge round from current investors at flat valuations or a slight increase, which has become more common in recent quarters.

- Utilize convertible instruments like SAFEs and Convertible Notes between priced rounds to secure additional financing, despite introducing some complexity.

- Implement cost-cutting measures, including scrutinizing software spend, fixed costs, and headcount, to reduce burn rate and conserve cash flow.

- Despite the challenges, the current environment offers opportunities for new startups, although growing existing ones proves to be more demanding.

See the overview here.