The Danish implementation of CSRD has been adopted

Published 2 May 2024

Today, 2 May 2024, the Danish Parliament adopted the final legislative proposal to implement the Corporate Sustainability Reporting Directive (“CSRD”) into Danish legislation.

The adoption of the proposal entails changes to the Danish Financial Statements Act, the Danish Act on Approved Auditors and Audit Firms, along with Danish corporate and financial legislation. Our update on the original legislative proposal can be read here.

Many Danish companies will with the implementation of CSRD be required to report on sustainability information in the management commentary of the annual report. The purpose of CSRD is to improve corporate sustainability reporting.

The companies subject to the legislation

The Danish legislation will be relevant for a number of companies; however, the companies will be subject to the legislation in stages:

- 1 January 2024: The implementation of CSRD will initially be relevant for large companies within reporting class D with more than 500 employees.

- 1 January 2025: Large companies in reporting class C and D with 500 employees or less will be subject to the implementation of CSRD.

- 1 January 2026: Small and mid-sized companies reporting under class D will be covered.

The implementation of CSRD will also be relevant for a large number of companies beside the abovementioned companies, due to the indirect impact of the reporting requirements entailed by CSRD. Meaning that many companies will need to address the sustainability data and reporting requirement and become familiar with the ESG concept due to requirements from their business partners.

The Danish implementation

The Danish implementation of the CSRD does not differ significantly from the CSRD and contains essentially the same substantive requirements. However, there are a few relevant changes.

Companies subject to the Danish legislation

The Danish implementation expands the scope to include more companies than required by the directive. This means that in addition to the companies covered by CSRD, commercial foundations, co-operatives and state-owned limited liability companies are also covered.

Commercial foundations

Commercial foundations that do not prepare consolidated financial statements in accordance with section 111(2) or (3) of the Financial Statement Act are also exempt from preparing sustainability reporting if the subsidiary prepares sustainability reporting in accordance with these requirements.

Auditors

The companies required to prepare sustainability reporting for the financial year of 2024, can at their ordinary general meetings in spring 2024, elect the auditor to prepare the sustainability reporting statement, even though the Financial Statement Acts has not yet entered into force and the auditor in question has thus not been authorized (assuming the auditor is authorized later).

Easier requirements for small and medium-sized companies

The Danish implementation contributes a limitation in the scope of reporting for small and medium-sized companies covered by section 99a by adding section 107 e. The provisions entail that small and medium sized companies that prepare annual reports according to the rules of reporting class D can limit their sustainability reporting to the requirements that apply to small and medium sized companies.

Size limits for accounting classes

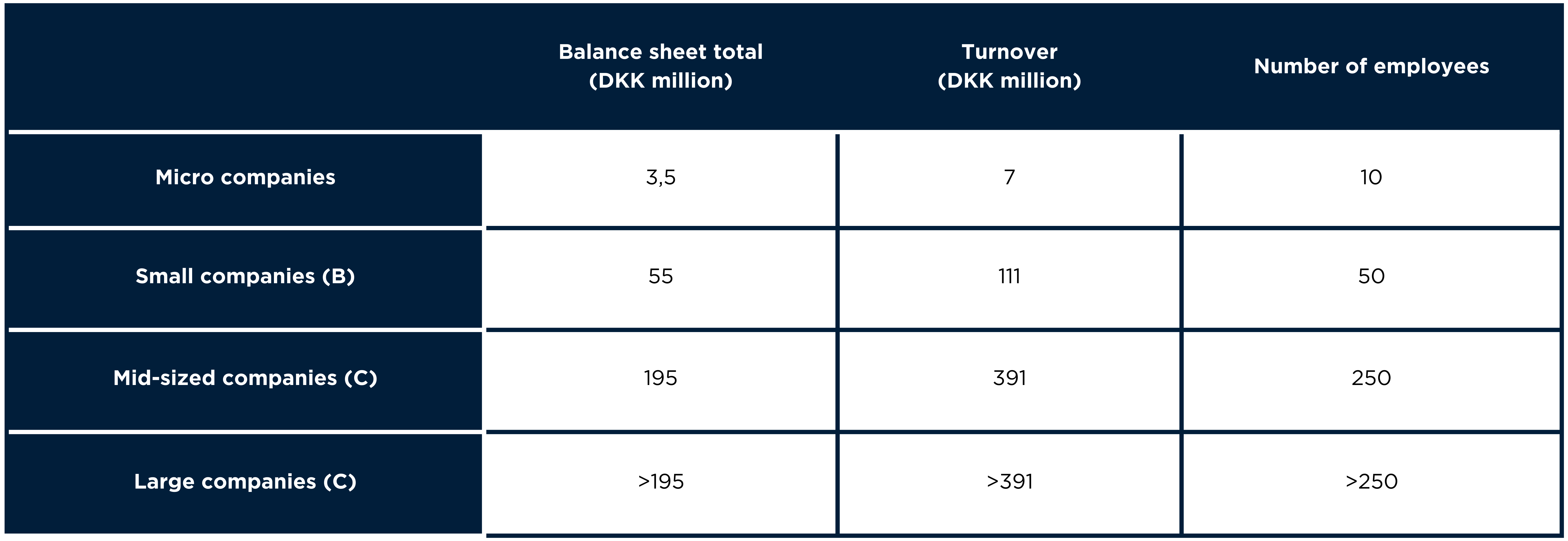

In connection with the Danish implementation the size limits for the reporting classes in the Financial Statements Act are changed as well. The size limits for reporting class B, C (medium) and C (large) will be increased by approximately 20-25% after which the new limits are as follows:

The effective date

The Danish implementation will be effective from 1 June 2024.

Next steps

By adopting CSRD into national legislation, it is no longer possible to postpone decisions on whether your company is directly or indirectly impacted by the sustainability reporting requirements. However, the extent of the indirect impact of the legislation, entailing reporting requirements on smaller companies due to their larger customers, is yet to unfold.

We still monitor the legislation closely to determine its impact on companies and with the purpose to navigate and assess if and when companies are impacted directly or indirectly by the Danish adoption of CSRD.