Taxation of Carried Interest

Published 12 November 2024

1. Background

Carried interest, often referred to as “carry,” is an important component of compensation for fund managers, particularly in private equity and venture capital. It represents a share of the profits generated by the investment fund, paid to the fund managers over and above their regular management fees. This performance-based incentive is designed to align the interests of fund managers with those of investors by encouraging managers to maximize the fund’s returns.

The treatment of carried interest often involves various tax implications and regulatory considerations that differentiate it from other types of income. Specifically, carried interest can be classified either as capital gains or salary, depending on various factors, including the structure of the fund and the nature of the fund manager’s role. This classification significantly impacts the tax rate applicable to carried interest, which can range from the lower capital gains tax rate to the higher personal income tax rate.

The purpose of this article is to provide an overview of the taxation of carried interest under Danish law.

2. Introduction to the Danish carried interest Scheme

The Danish rules on taxation of carried interest (the “CI Scheme”) are set out in Sections 16 I and 16 J of the Danish Tax Assessment Act. The purpose of the CI Scheme is to ensure that carried interest is subject to the same level of taxation as ordinary salary income rather than capital gains taxation.

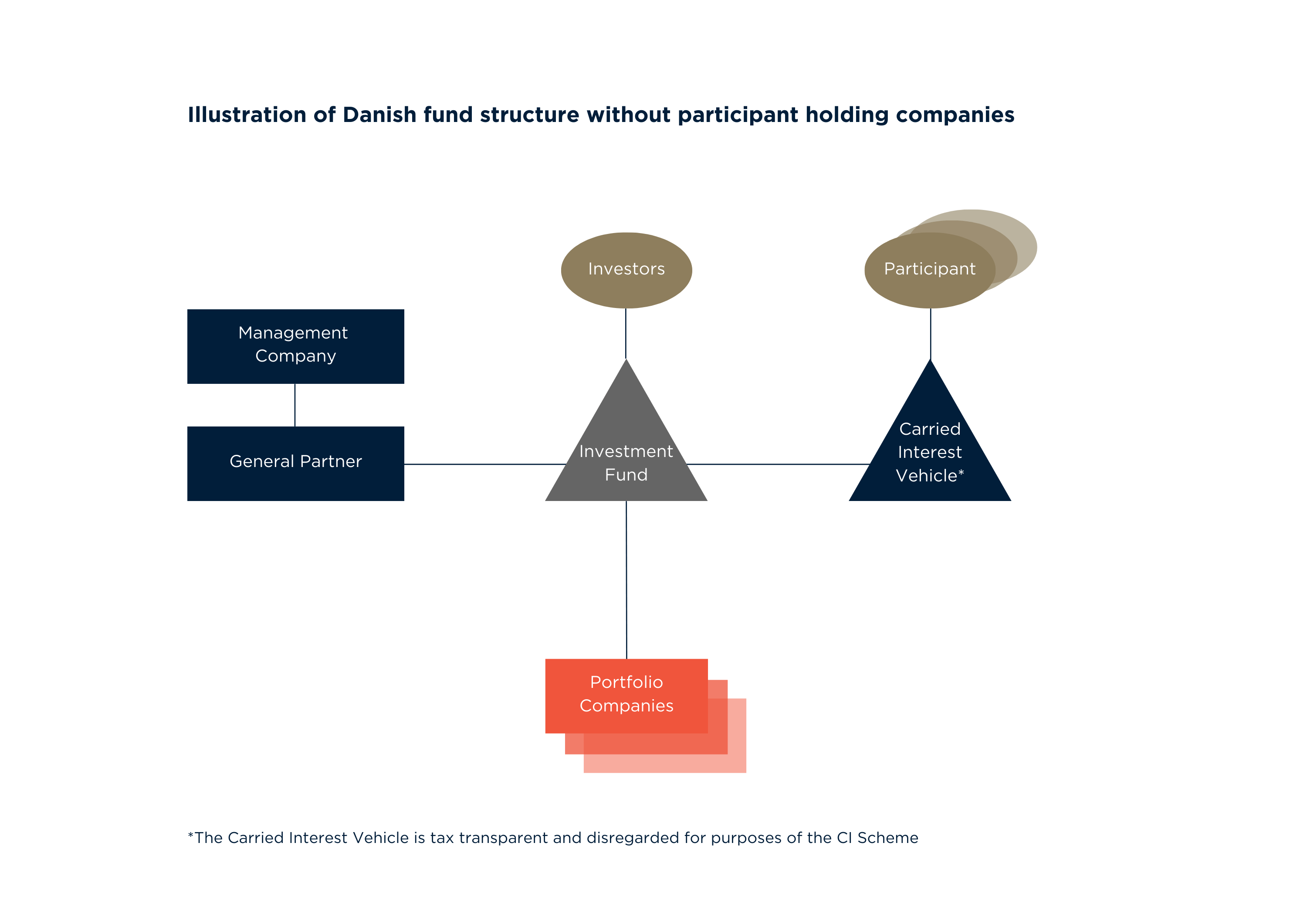

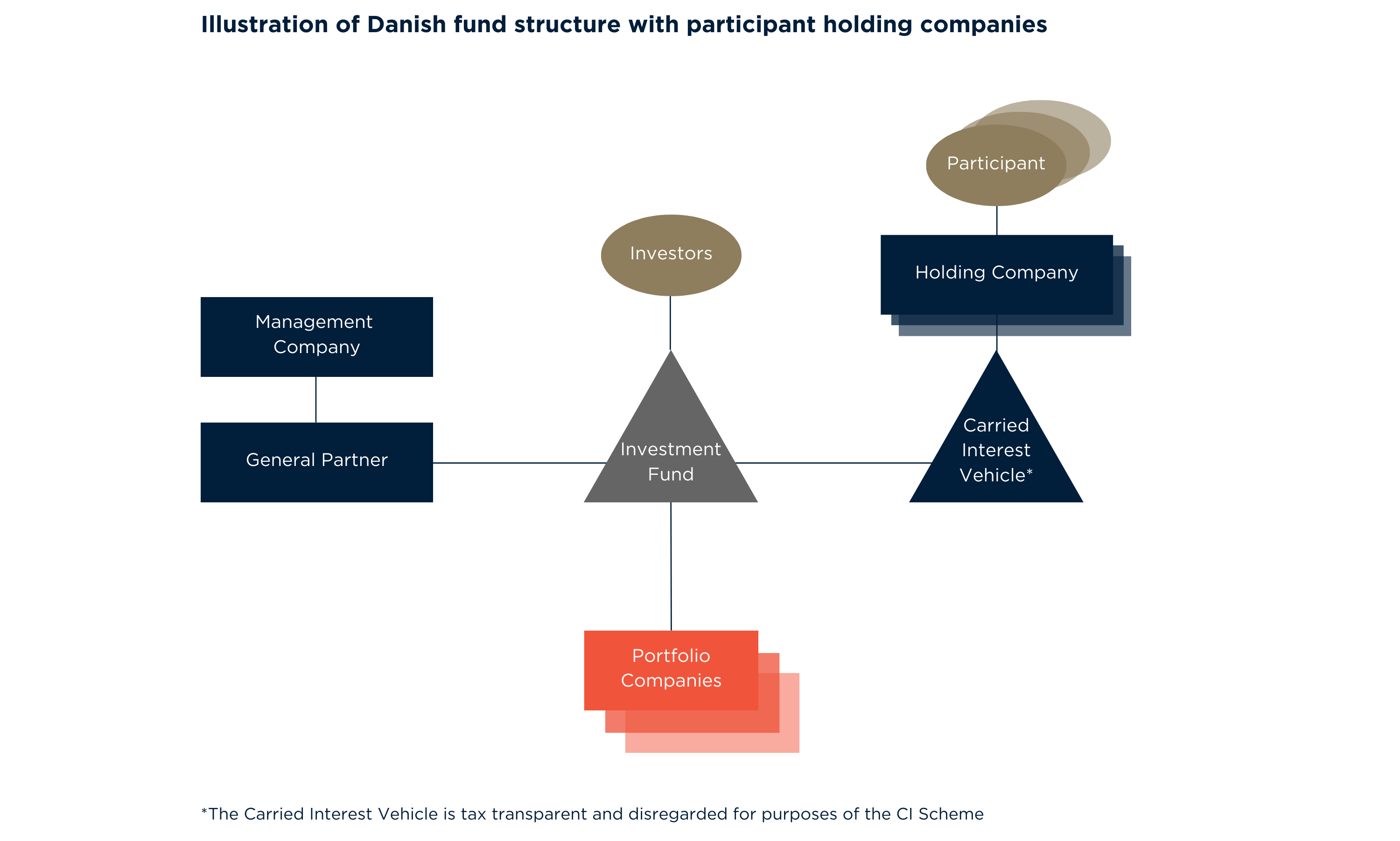

Overall, the CI Scheme implies that carried interest is taxed as personal income for participants who receive carried interest directly from an investment fund, whereas carried interest is taxed as so-called CFC income for participants who receive carried interest from an investment fund through a company. Details on the CI Scheme are set out below.

Illustration of a classic Danish fund structure is attached below.

3. Criteria for the application of the CI Scheme

The following criteria must be met for the application of the CI Scheme:

(i) The participant must be fully liable to tax in Denmark (in Danish: “fuldt skattepligtig”). Generally, to be fully liable to tax in Denmark the participant must either stay in Denmark for six consecutive months or be a resident in Denmark.

(ii) The participant must have a preferential position in the investment fund. The participant has a preferential position when it has been agreed that the participant’s proportionate share of the result of the investments made through the fund exceeds the participant’s proportionate share of the total share capital of the fund. The total share capital includes both the contributed capital and loan capital contributed by participants in the fund.

(iii) The fund must be a private equity, venture capital or infrastructure fund. Private equity and venture funds are investment entities that invest in shares with a view to wholly or partly acquiring one or more companies, etc., with a view to participating in the management and operation of these. Infrastructure funds are investment entities that raise capital for direct or indirect investment in the establishment or expansion of infrastructure plants and facilities and the management of ownership and possibly operation of such plants and facilities.

(iv) If the participant receives carried interest through a company, the participant must control such company. The “company” may be either a Danish or foreign company or association etc. The participant is considered to control the company, if (a) the participant directly or indirectly, independently or jointly with a related party, owns more than 50 percent of the share capital of the company or holds more than 50 percent of the voting rights in the company, or (b) the participant or a related party of the participant is a co-founder of the investment fund or is or has been a participant in the management or operation of the investment fund or in companies owned by it.

4. Taxation pursuant to the CI Scheme

It is only the excess return on investments made through the investment fund that are included in the calculation of taxable income under the CI regime. Excess return means such part of the return on investment that exceeds a standard return, which means the return achieved by participants in the investment fund that do not have a preferential position, i.e. the return obtained by the regular investors in the fund.

For participants, who receive carried interest directly from the investment fund, the excess return must be included in the personal income of such participants. Consequently, such carried interest is subject to the general personal tax rate of the participants. In Denmark, income exceeding DKK 640,108 (2024 level) before labour market contribution is subject to a tax rate of approximately 56 percent.

For participants, who receive carried interest from the investment fund through a company, the excess return of the company on investments made via the fund, must be included as CFC income when calculating the taxable income of the participant. This means that the participant is taxed on the company’s carried interest as if the carried interest had been earned directly by the participant. The Danish tax rate on CFC income is currently 22 percent.

When calculating the taxable income for participants, who receive carried interest from the investment fund through a company:

(i) The share of the company’s positive excess return to which the participant is directly or indirectly entitled is included.

(ii) If a negative excess return can be calculated in an income year, the negative excess return can be deducted when calculating the excess return in later income years.

(iii) Dividends are not included to the extent that (a) the dividend is distributed from the company or from a company (etc.) through which the participant directly or indirectly controls the company, and (b) the dividend does not exceed the tax that the participant must pay on the income of the company.

5. Tax Relief under the CI Scheme

Participants, who receive carried interest directly from the investment fund, are granted relief for foreign taxes and taxes imposed on the participant on the excess return in accordance with the general Danish tax legislation. The deduction cannot exceed the part of the total Danish and foreign taxes that proportionately falls on the participant’s excess return.

Participants, who receive carried interest from the investment fund through a company, are granted relief for the company’s foreign taxes and for taxes imposed on the excess return in accordance with the general Danish tax legislation. The deduction cannot exceed the part of the total Danish and foreign taxes that proportionately fall on the company’s excess return.

6. Disclosure obligations under the CI Scheme

Participants who are required to include carried interest in their income statement must submit to the Danish tax authorities information on how the taxable excess return has been calculated, including information on:

(i) The identity of the natural or legal persons from whom the income originates.

(ii) How any deduction for negative excess return from previous income years has been calculated.

(iii) How the income, on which the calculated excess return is based, is composed.

(iv) How the standard return is calculated.

(v) Any taxes for which a deduction is requested pursuant to clause 2 above.

(vi) Agreements on the distribution of excess return received by a company.

The participant must also provide information about dividends that are not included in the participant’s taxable income in accordance with clause 4 (iii) above.

7. Refund of taxes paid under the CI Scheme

If a participant has paid tax on carried interest for an income year, the tax may be repaid in cash to the taxpayer in a later income year, to the extent that the carried interest is repaid to the other investors by a retrospective adjustment of the distribution of returns in the investment fund. To the extent that the participant has received dividends that have not been included in the taxable income in accordance with clause 4 (iii) above, the cash payment is included in the taxable income in the income year in which the tax is repaid.