ESG & Impact: Investment Process and Portfolio Management

Published 24 February 2021

Many investors (from business angels to mature stage investors) focus on how to develop and implement responsible investment practices specifically for their own organisation. We aim to provide guidelines for those starting to implement ESG policies, as well as those wishing to develop their existing processes.

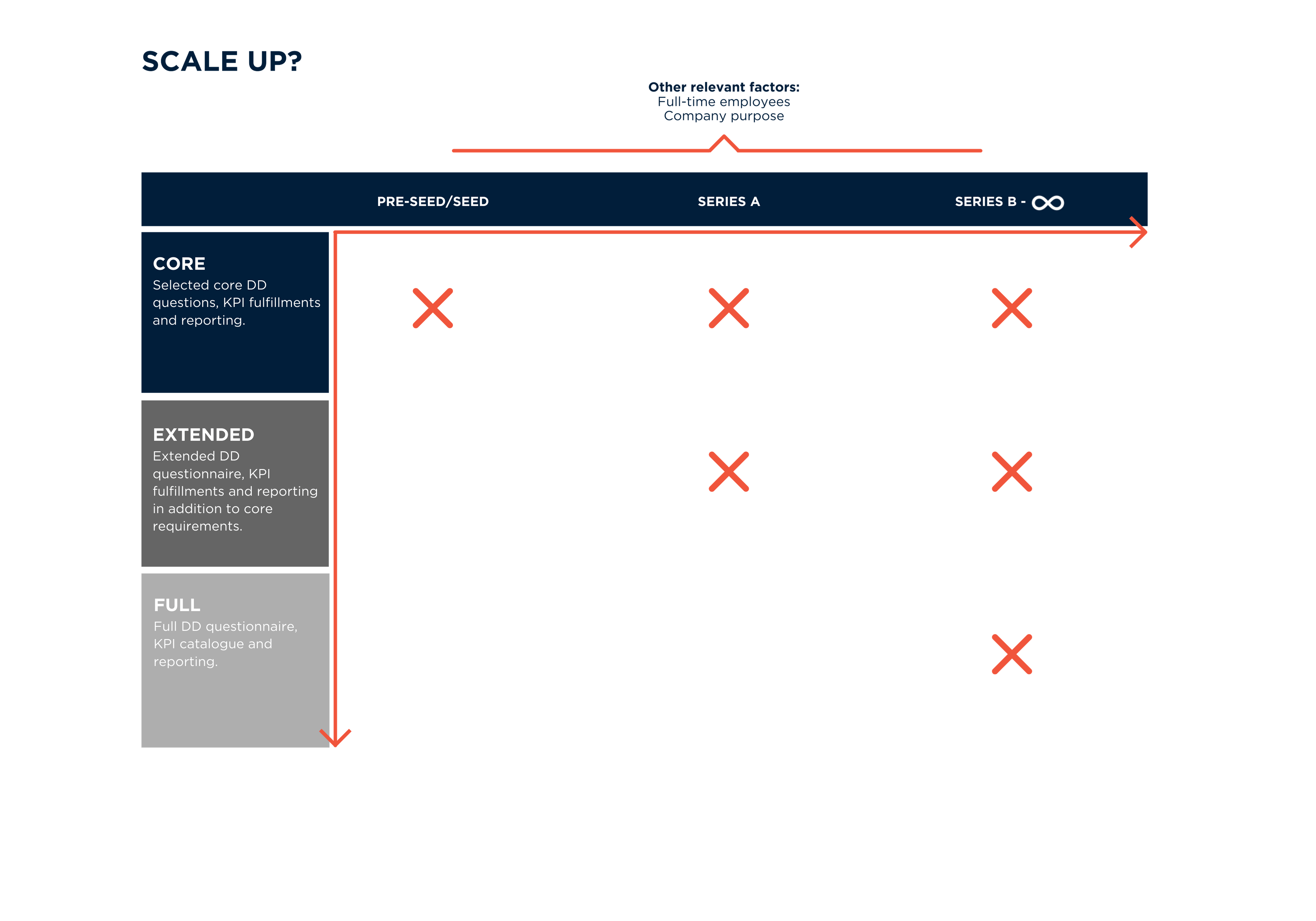

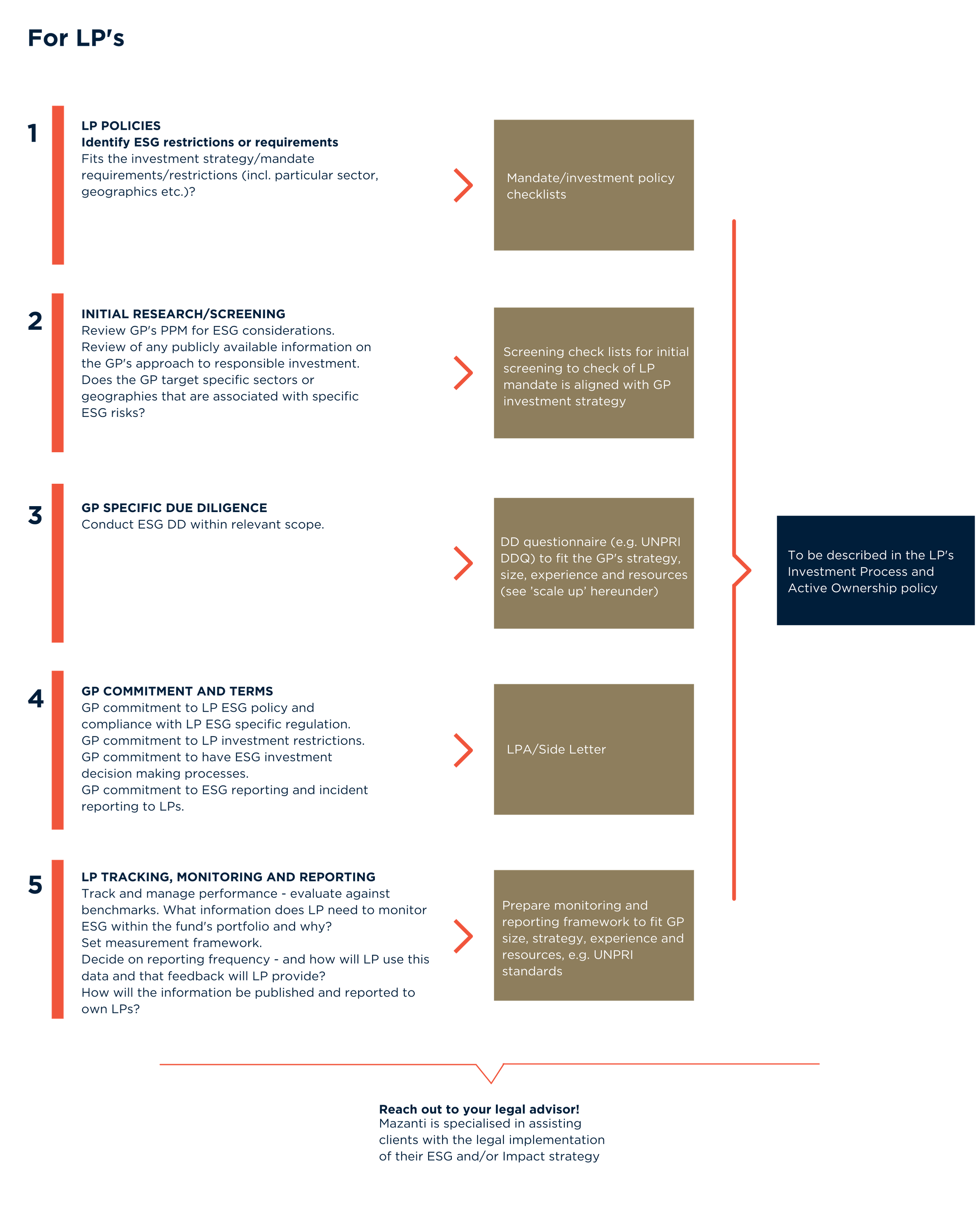

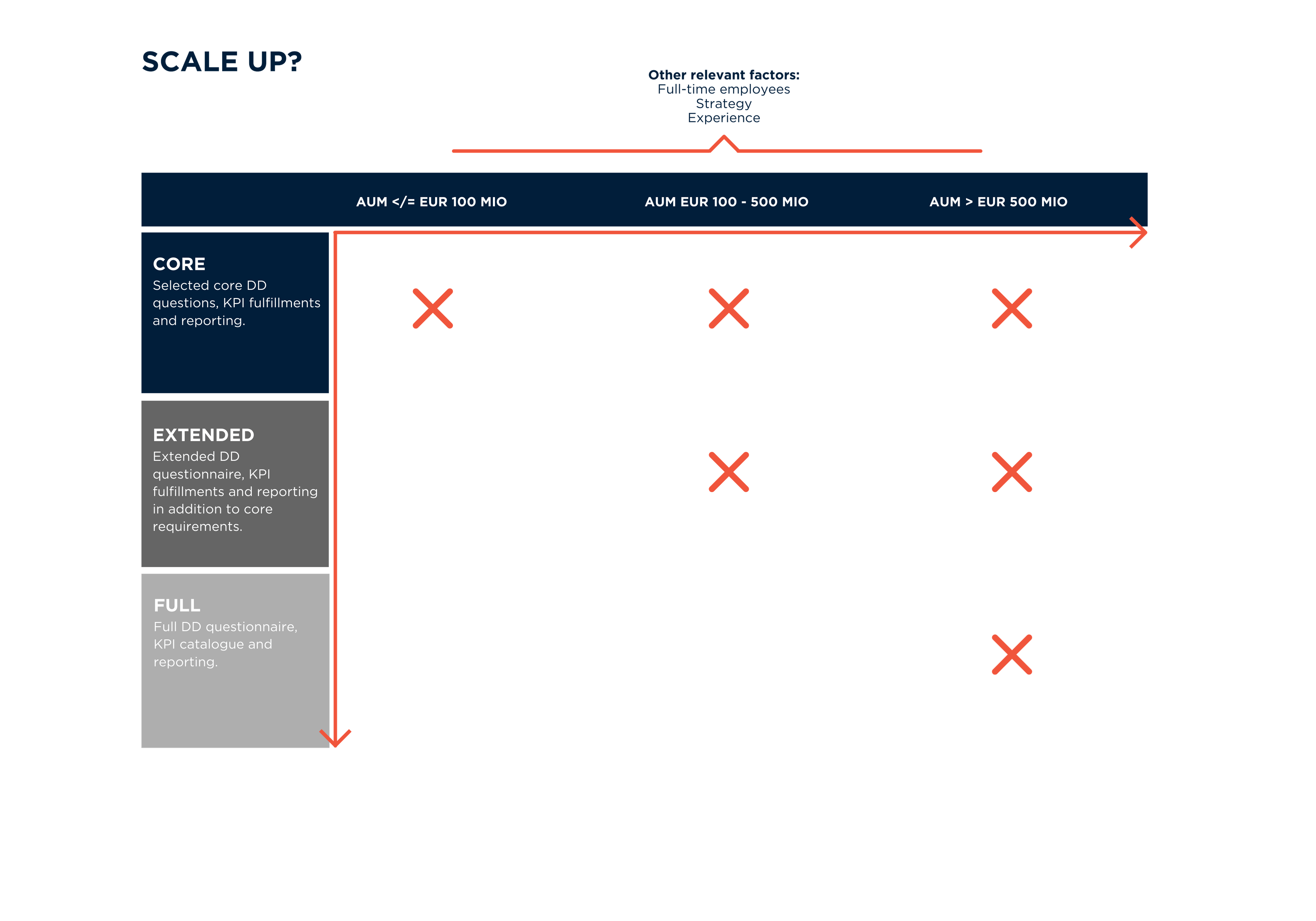

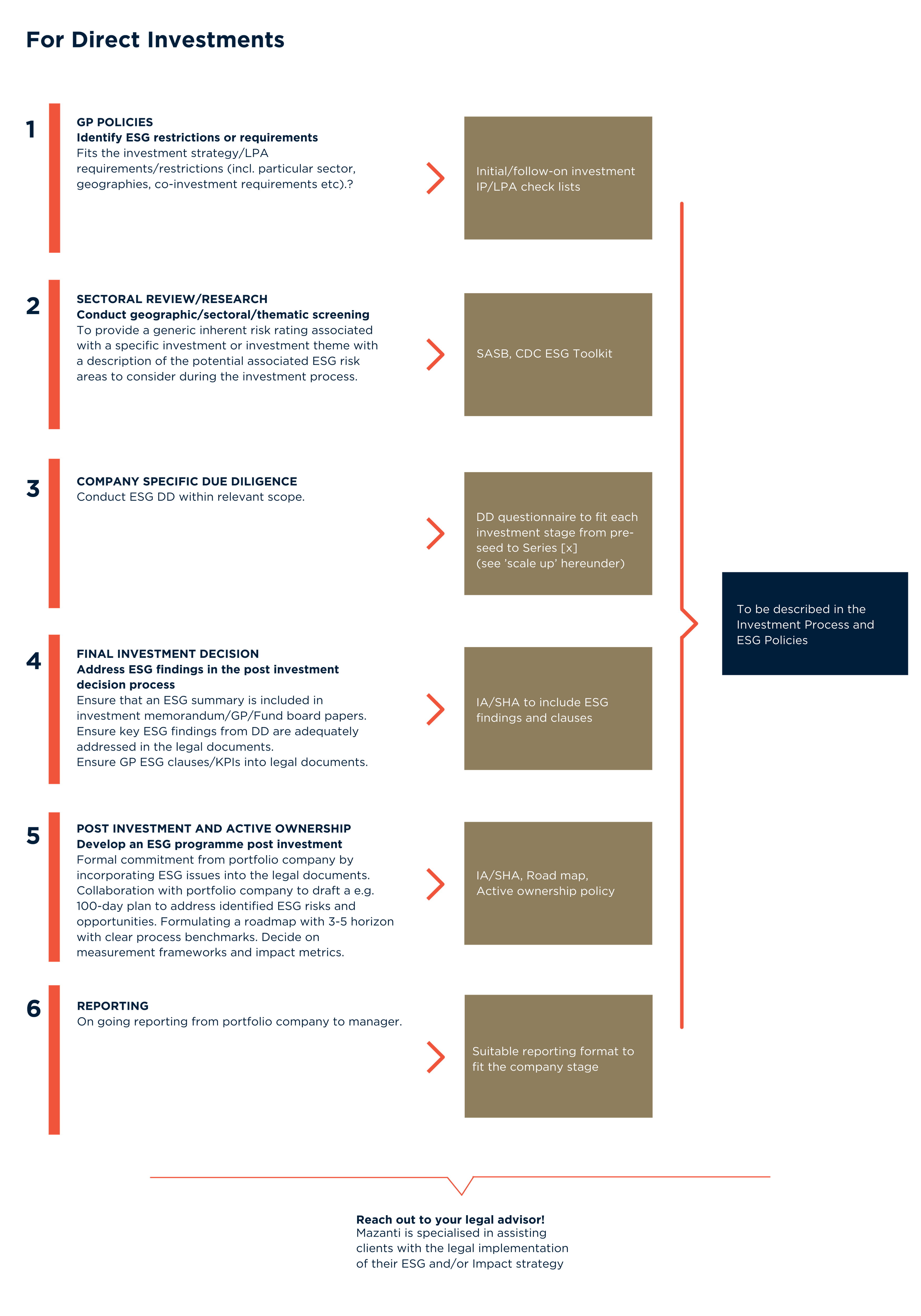

We believe it’s key for investors to first consider what they want to achieve as well as why and how (read our suggested steps for this process here). Once those steps have been identified and addressed, the next phase focuses on how to implement the ESG strategy into the relevant policies and legal agreements governing the individual investments. Below, we have outlined our suggested approach to this for both LP’s in their fund investments and for direct investments – but remember, there is no one-size-fits-all, and the approach should always fit the investment stage and the specific investment case. We have illustrated this thinking with a scale-up approach below.

Our guidelines for LP’s are inspired by the internationally-recognised Principles for Responsible Investment (UN PRI) and our suggested guidelines for direct investments are inspired by Invest Europe’s ESG best practice guide.

Remember, there is no one-size-fits-all. It’s important to keep the stage of the investment and the specific investment case in mind ↓

Remember, there is no one-size-fits-all. It’s important to keep the stage of the investment and the specific investment case in mind ↓