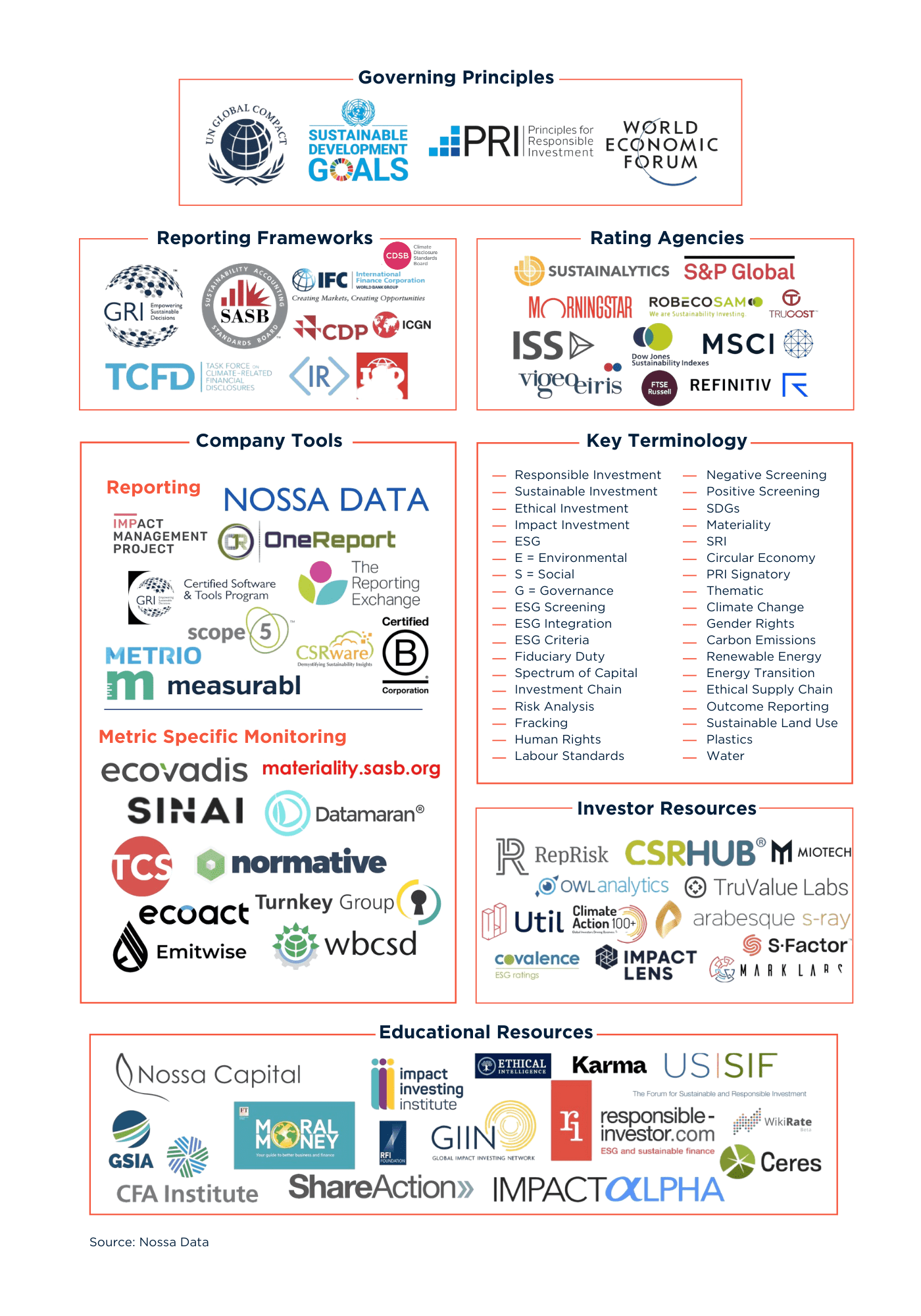

The consideration and assessment of Environmental, Social and Governance factors is becoming a key driver for investor’s decision-making. The challenge for both investors and companies lies in the substantial number of frameworks that already exists for ESG reporting. As the diagram below illustrates, there are so many, that it can be difficult to know which one to use.

So, if you’re confused by looking at the diagram below, we understand. One of the main challenges for implementing ESG consideration (for both investors and companies) is that the market currently lacks a commonly accepted framework and methodology to measure ESG performance. As this creates key barriers for ESG integration and the voluntary nature of these presents a risk for cherry picking and greenwashing, a global standard is needed.

However, there are efforts to try to harmonise these different frameworks and standards. The Corporate Reporting Dialogue, for example, has launched the Better Alignment Project, a two-year collaboration launched in the fourth quarter of 2019 between CDP, CDSB, GRI, the International Integrated Reporting Council (IIRC) and SASB, to help synchronize the different reporting frameworks. This collaborative project will initially focus on aligning standards with the recommendations published by the Task Force on Climate-related Financial Disclosures (TCFD).”