Time-Barring in relation to Unpaid Partnership Commitments

Published 17 June 2020

When will unpaid commitments in a Danish limited liability partnership become time-barred? And when will a partnership forfeit its claim to an unpaid commitment due to time-barring? How does subsequent closings in the partnership affect time-barring? And how may the limitation periods be interrupted? Continue reading as this article attempts to provide you with the answers to this line of questions.

The Rules

With respect to a Danish limited liability partnership (“Partnership“) (dk: kommmanditselskab), time-barring of unpaid commitments under a limited partnership agreement (LPA) is governed by § 2 a of the Danish statute of limitation (dk: forældelsesloven):

“For claims that are based on a written agreement about contributions to a company, the limitation period starts to run from no earlier than the time when the company decides to request payment of the contribution. Notwithstanding the first sentence, the limitation period shall, however, start to run not later than 10 years after the commencement date in accordance with § 2.”

In Danish: “For fordringer, som støttes på skriftlig aftale om indskud i et selskab, regnes forældelsesfristen tidligst fra det tidspunkt, hvor selskabet beslutter at indkalde indskuddet. Uanset 1. pkt. regnes forældelsesfristen dog senest fra 10 år efter begyndelsestidspunktet i henhold til § 2.”

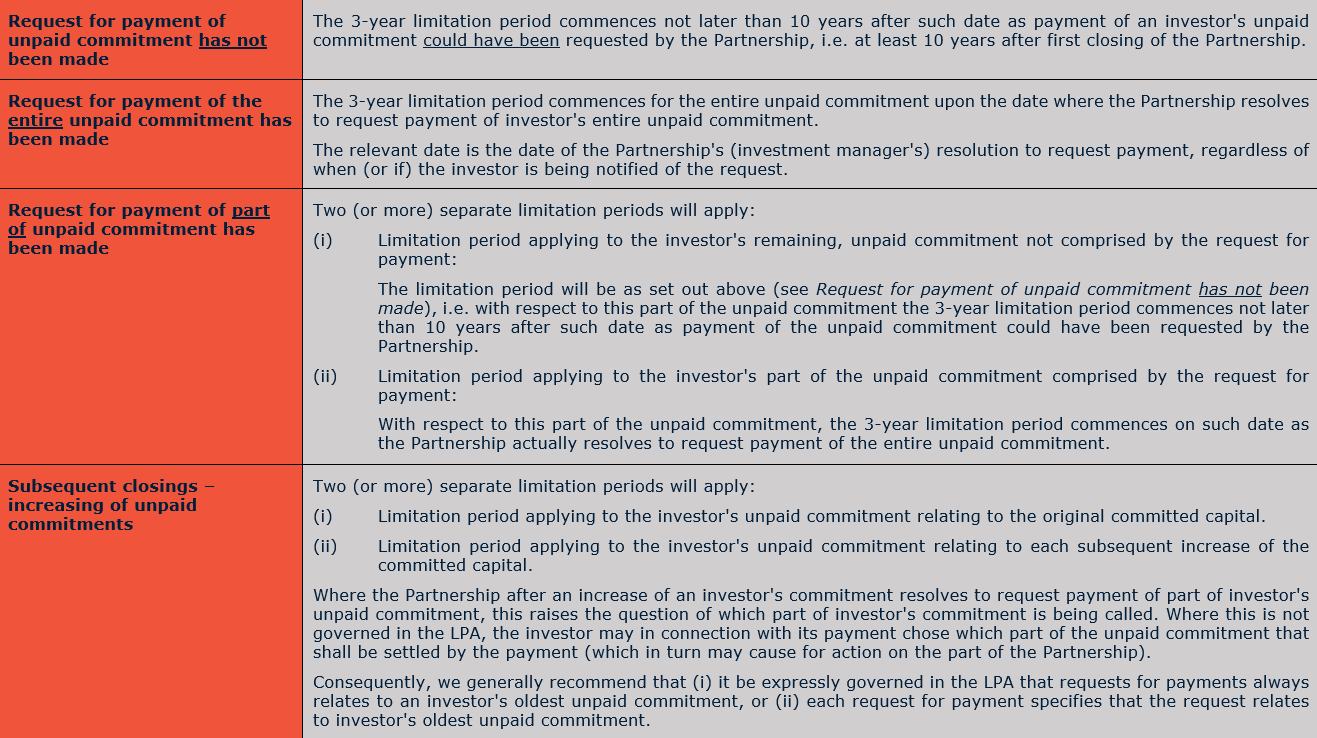

As the main rule, this means that:

- The 3-year limitation period commences on such date when it is actually resolved (typically by the investment manager of the Partnership) to request payment from an investor of an unpaid commitment.

- Where the Partnership does not resolve to request payment of the unpaid commitment, the 3-year limitation period will commence not later than 10 years after such date as payment of the unpaid commitment could have been requested by the Partnership.

Limited Partnership Agreements (LPA)

When can a request for payment of unpaid commitments be made?

Danish law Partnerships are often established in two steps:

- First, the Partnership is founded based solely on a simple version of articles of association with a general partner and a single limited partner (typically the investment manager’s investment and carried interest vehicle). On this basis, the Partnership is registered with the Danish Business Authority and the Danish Financial Supervisory Authority.

- Next, the investors will subscribe for committed capital and receive shares in the Partnership. The LPA governing the Partnership will be concluded and the Partnership’s articles of association will be amended to reflect the LPA (typically referred to as first closing). The Partnership will not have any activity prior to first closing.

In the period between the foundation and first closing of the Partnership, the Partnership is marketed to potential investors. Depending on the fundraising activity and the investor interest, this period may have a duration of several months.

Upon first closing the LPA will come into force, and the LPA will include provisions governing the Partnership’s right to demand payment of the investors’ unpaid commitments. While the specific conditions for demanding payments differ, the management team will often seek as much flexibility as possible, e.g. along the lines:

“[Subject to the fulfilment of certain conditions precedent,] the investment manager shall be entitled to demand payment by effecting draw down rounds of unpaid commitments from the investors on an “as is basis” for the purpose of enabling the partnership to make investments and fulfil its other obligations.”

Such wording does not pinpoint the exact time when payment of the unpaid commitment can be requested by the Partnership but allows room for manoeuvre. However, since payment of the unpaid commitment cannot be requested prior to first closing (at least), unpaid commitments that have not been requested paid in will not become time-barred until at least 13 years after first closing – that is to say a date post liquidation of the typical Partnership (with a 10 year lifetime and possibility of extension for up to additional 2 x 1 year).

Limitation periods

Interruption of limitation periods

Reconfirmation of unpaid commitments

Limitation periods may be interrupted by the investor reconfirming its unpaid commitment. A new 3-year limitation period will then apply from the date of investor’s reconfirmation.

Danish statute of limitation cannot by prior agreement between the Partnership and an investor be derogated from to the detriment of the investor. Consequently, the 3-year limitation period will commence as per the date of the reconfirmation regardless of what is stated in the reconfirmation in relation to the limitation period.

Payment of part of an unpaid commitment

Where an investor fulfils a request for payment of part of investor’s unpaid commitment within three years after receipt of the request, this may often constitute a reconfirmation of the investor’s remaining unpaid commitment. As the main rule, this will interrupt the limitation period (whereby a new 3-year limitation period will commence as per the date of payment), provided that the payment is made in circumstances that does not imply any actual dispute about the size of the unpaid commitment.

However, the question of whether a payment will constitute a reconfirmation must always be determined based on a specific assessment of the circumstances, and we do generally not recommend relying solely on such interruption being effective.

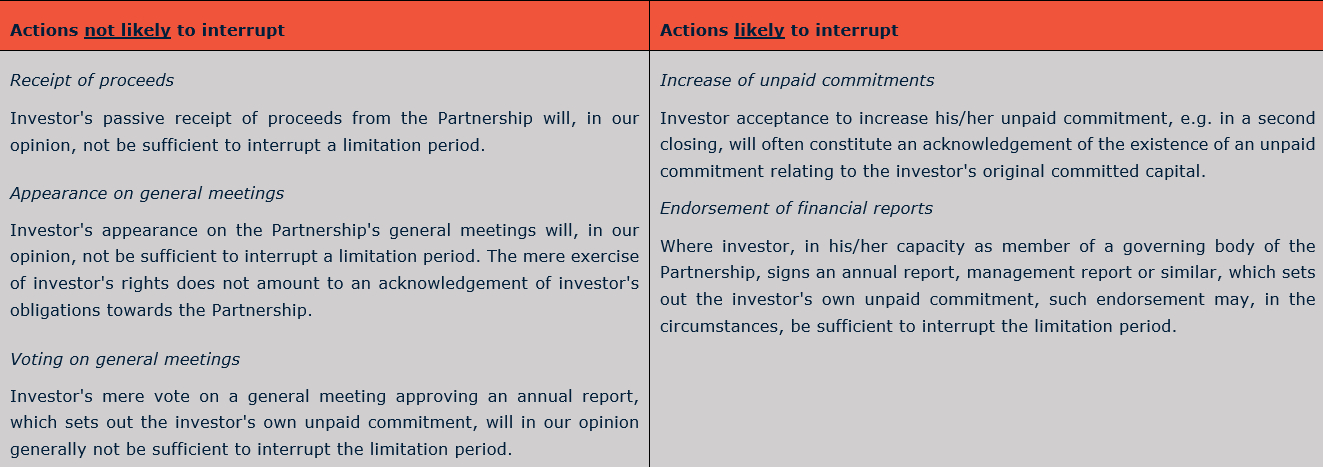

Other investor behaviour

The limitation period may be deemed as interrupted where an investor, by investor’s course of action, acknowledges the existence of the unpaid commitment.

The investor behaviour must be an active and relevant action.

However, the question of whether a specific investor behaviour will constitute a reconfirmation must always be determined based on a specific assessment of the circumstances.